What is Protection Plus

Thank you for choosing to partner with Protection Plus. Our goal is to make sure that we always provide you with the excellence in service you should expect from a professional audit assistance company.

Below is a complete list of instructions on how to set your Protection Plus markup fees into your Tax Pro Alliance software in order to maximize your numbers and to increase your profits.

A comprehensive audit assistance program is available through Protection Plus, which is fully integrated in your Tax Pro Alliance software. The service works with 1040 returns, including Schedules A, C, and E, handles ITIN/W-7 rejections, assists in getting denied EIC claims funded, offers tax debt relief assistance, and pays up to $2,500 in penalties, interest, and tax liabilities should an error occur (exclusions apply).

Desktop Setup

Remember, if your office computers are networked, you only do these steps in the transmitting computer. If you have multiple computers that are NOT networked, Protection Plus must be set at each one.

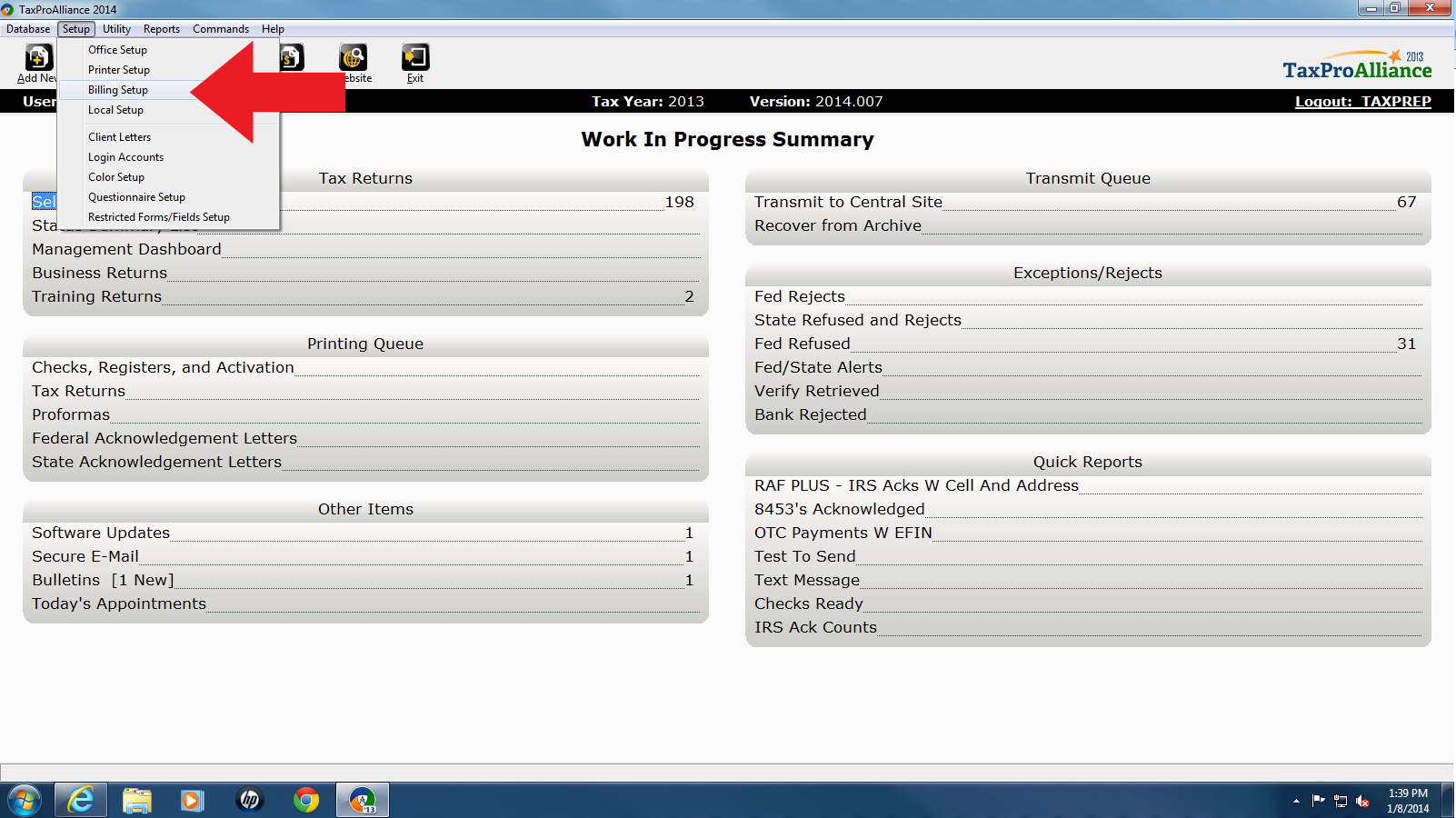

Select the “Billing Setup” tab, this screen will appear:

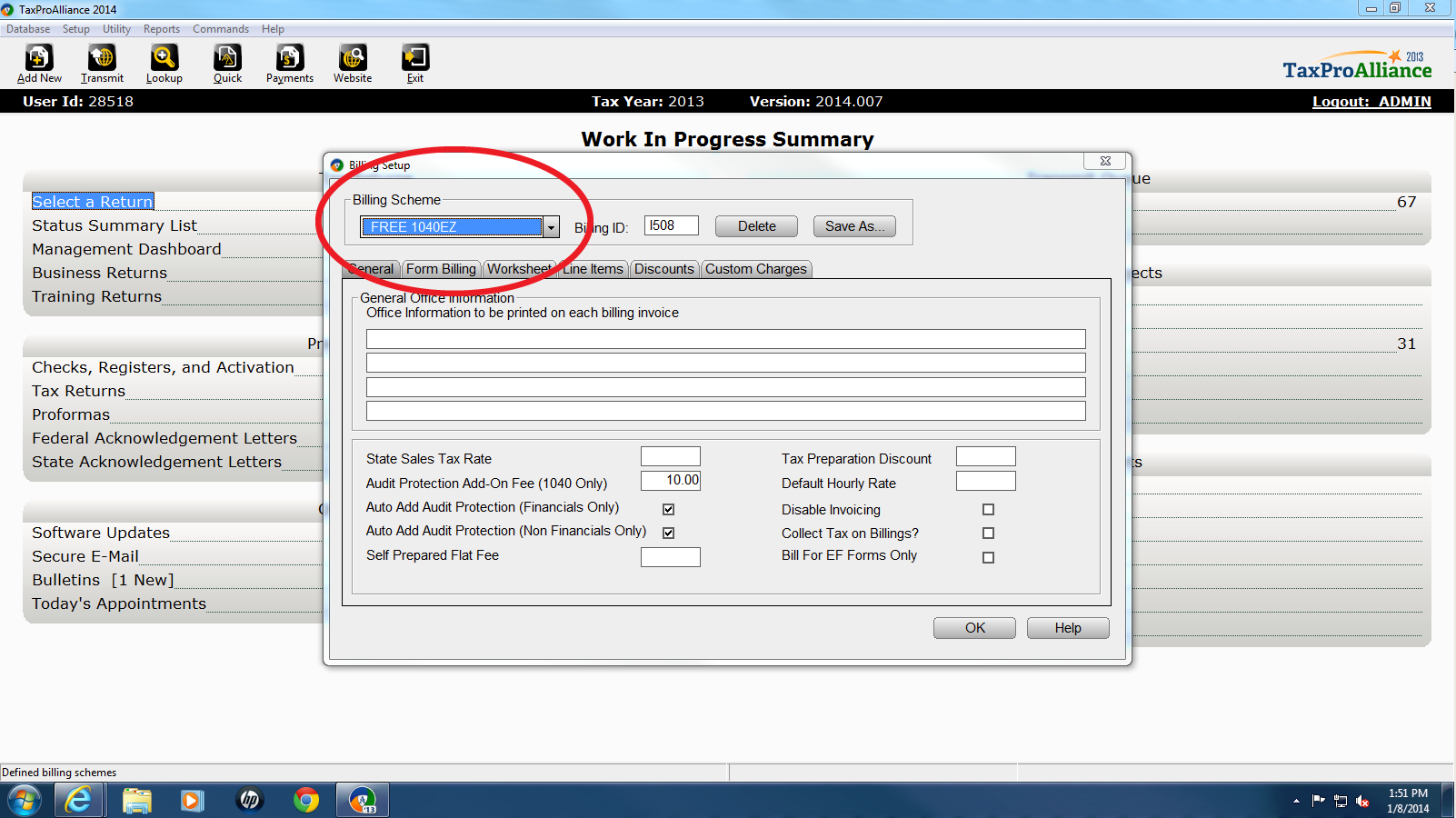

The fee is a nominal $39.00. Due to this low cost, you can add a mark-up amount and pass this on to the tax payer. If you wish to add to the price charged the taxpayer for the audit protection service, enter that amount in the box to the right of Auto Protection Add-On Fee (1040 Only). This example used $10.00 as the mark-up amount. Your mark-up amount plus the base cost of $39.00 will be the Audit Assistance fee that appears as a separate line item on the client’s invoice. If you choose not to add on to the $39.00 fee, enter $0 or just leave the box blank. You have the option to mark-up the fee from zero, one dollar or up to $60.00. The amount you add on is a decision your company makes.

MAKE SURE THE BOX IS CHECKED NEXT TO “AUTO ADD PROTECTION PLUS (financial products only). This will ensure Protection Plus is added to every bank product return.

To add Protection Plus audit assistance to each non-bank return, check the box to the right of Auto Add Protection (Non-Financials Only). You will be charged $39.00 for each of these returns. Each non-bank return that is e-filed and acknowledged by the IRS will be charged $39.00 if the Protection Plus audit assistance contract is on the return.

To remove Protection Plus from a particular return, please call the Protection Plus help line at 866-942-8348.

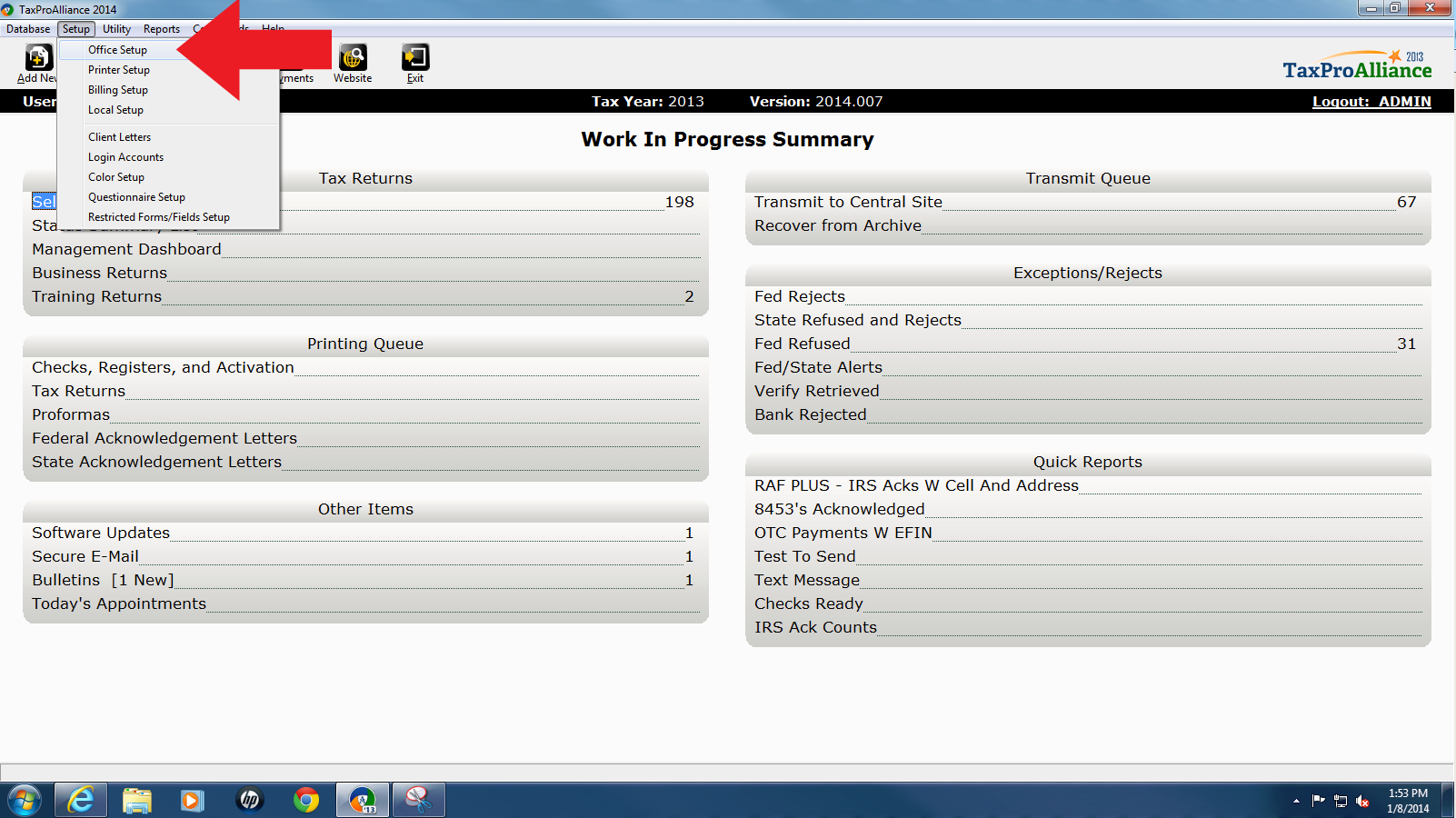

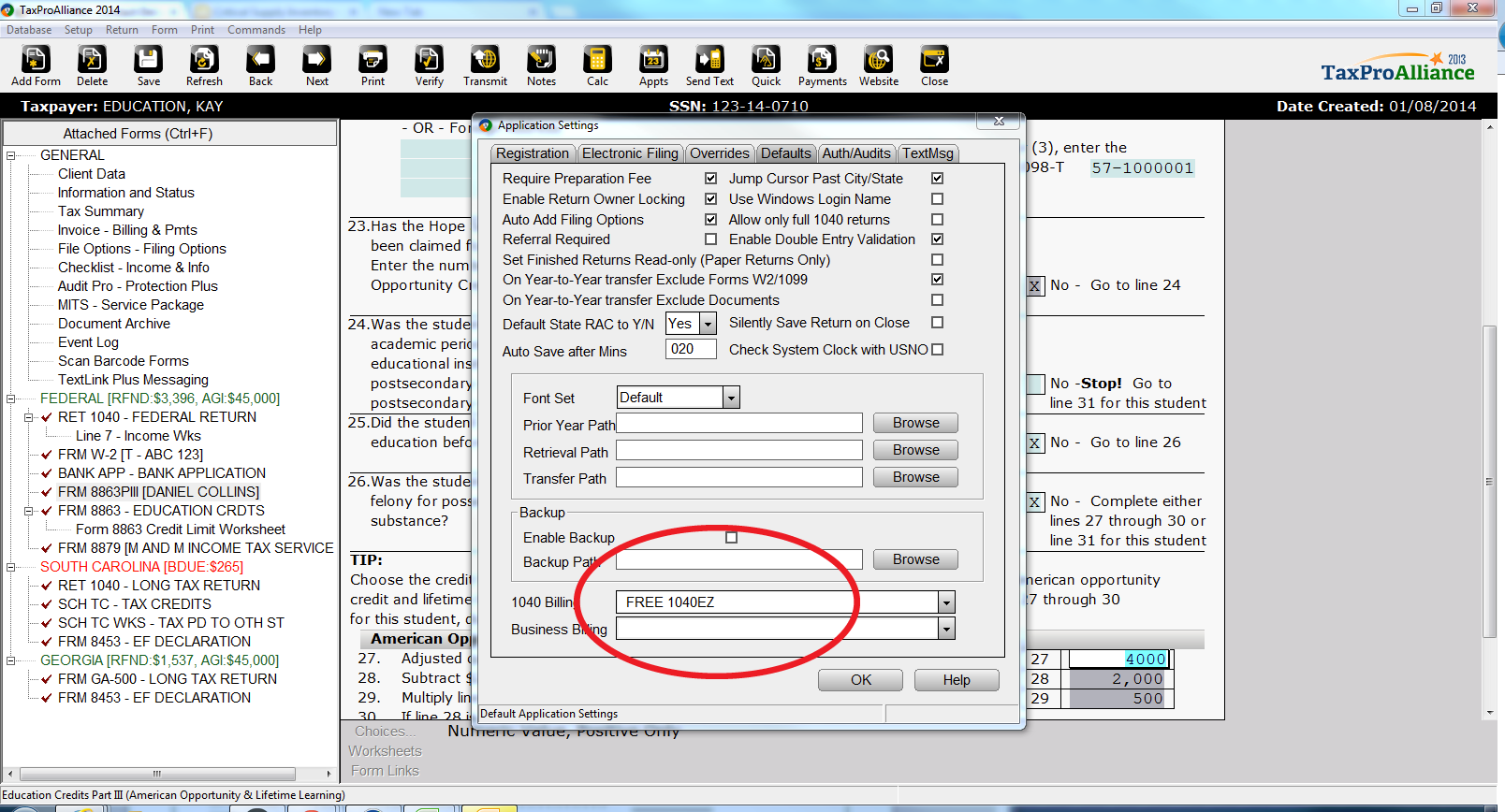

Select the “Defaults” tab. You should be at the ‘Application Settings’ screen. In the 1040 Billing window, select the Billing Scheme that matches exactly the billing scheme on the Billing Setup screen.

Testing the Setup

It is extremely important that you test your work to ensure that Protection Plus audit assistance is properly added and your mark-up is added to your tax returns. The testing process does not require that you complete the return. It is not necessary to add any information other than mentioned in the Test.

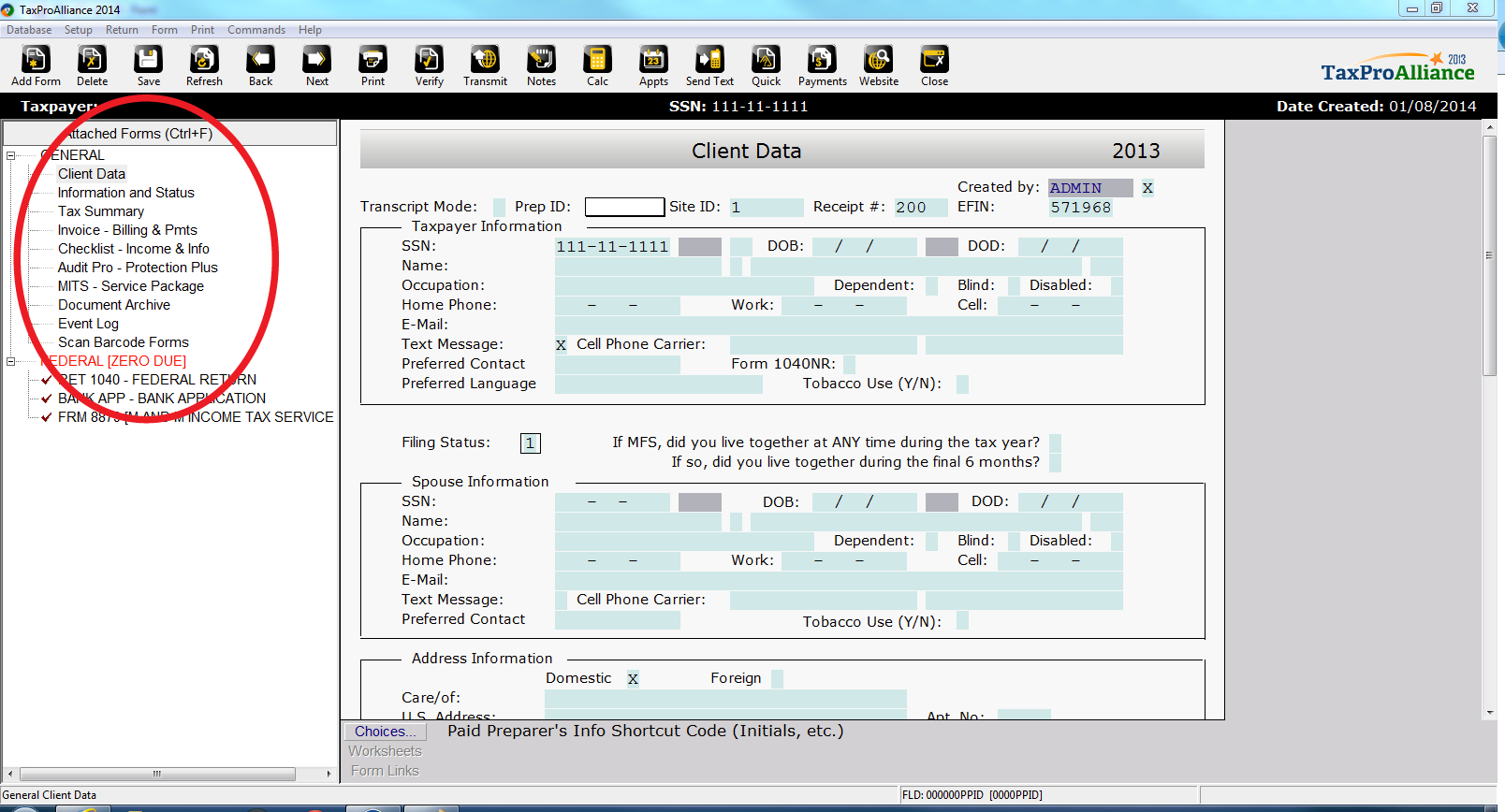

Add a NEW RETURN. DO NOT use a return already in your system. Enter a filing status.

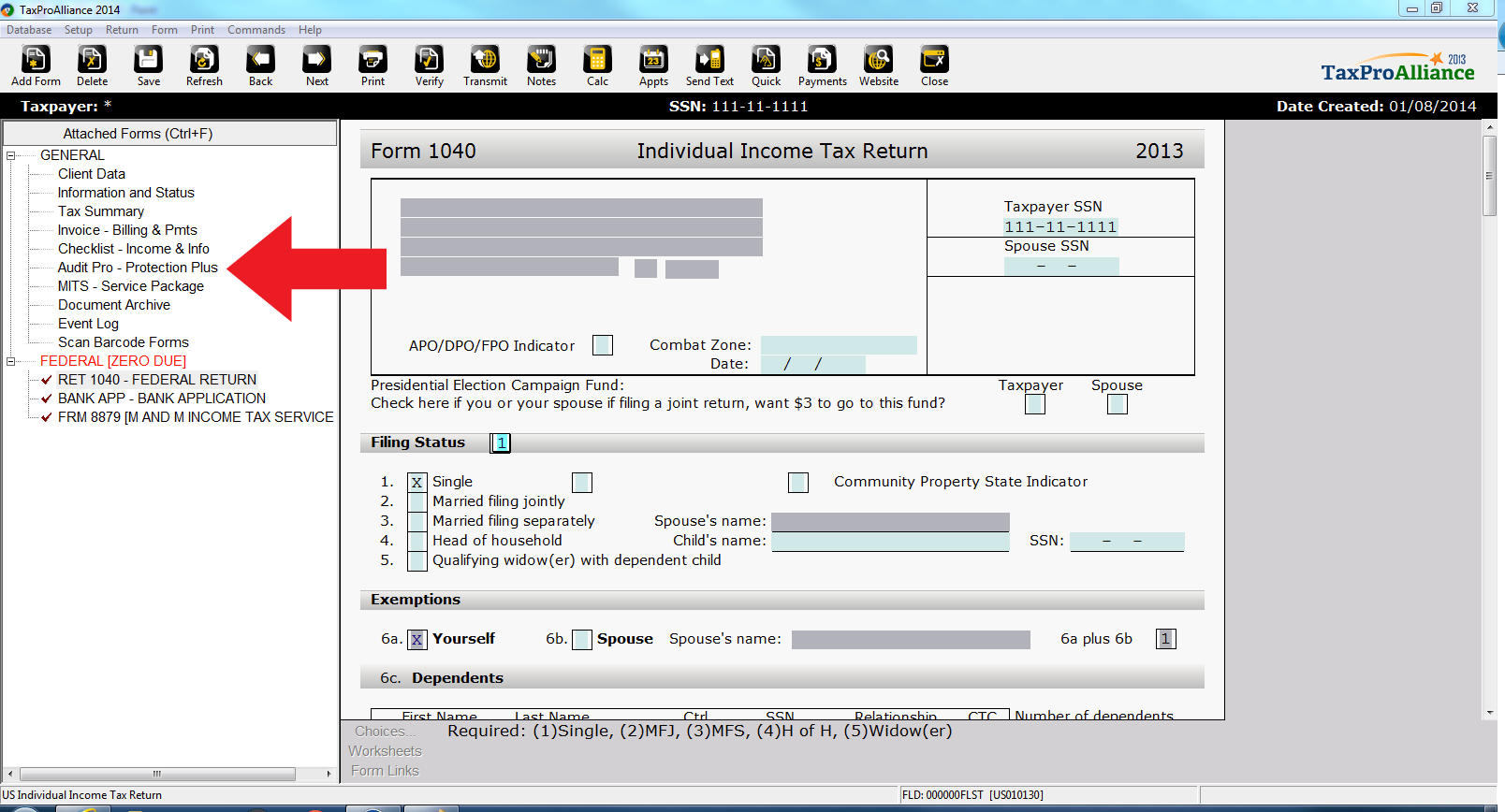

On the Billing Scheme screen, if you chose to auto add audit assistance to both Financials and Non-financials, the auto assistance form will automatically attach to each return. Look at the list of Attached forms, General section. Audit Pro-Protection Plus should be in this list.

If you selected Auto Add Protection Plus to Financials only, audit assistance will be offered to each of your RT clients. Note on the screen below that Auto Pro Protection Plus is not listed in the GENERAL section of Attached Forms.

From the Attached Forms section on the left under Federal, double click the 8879. Put a 5 in the refund type. Hit “Enter” and “Refresh”. Audit Pro Protection Plus will be added to list of forms attached to the return.

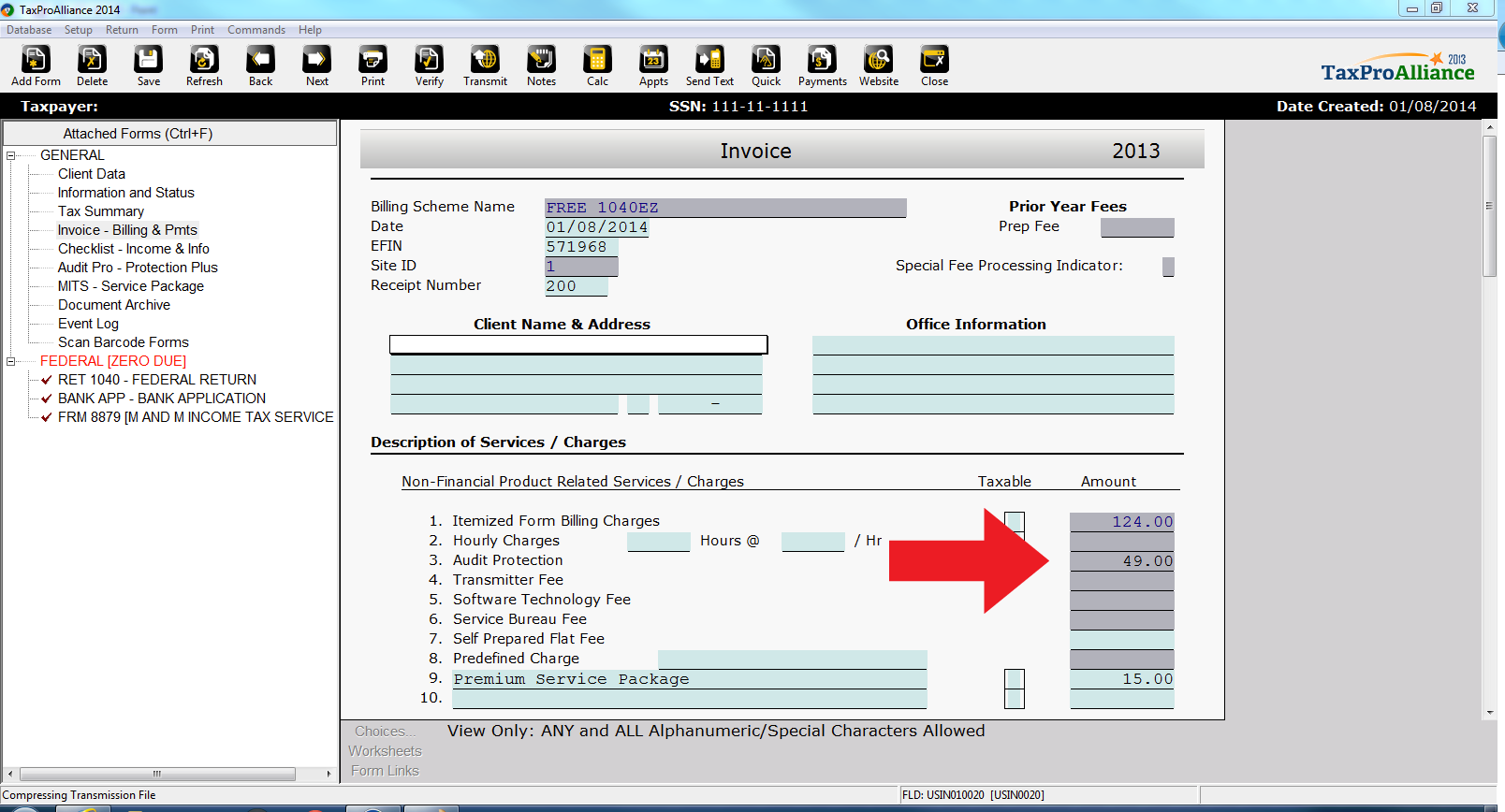

It is also important to include a review of the Client’s invoice in this test. Audit Protection is line 3 of the invoice. The charge should be the base cost of $39.00 PLUS your mark-up amount. For example, if you added $10.00 as your mark-up amount, $49.00 should appear as the cost of Protection Plus. If this is not the case, the mark-up was not added correctly.

Troubleshooting

IF your fees do not include the mark-up, while you are in this return, select “Return” from the top tool bar. Scroll down the list and select RELOAD BILLING. Just click on this tab and your billing set-up should adjust for the addition of the Protection Plus fees. To ensure the mark-up was added, start a new return and repeat the testing procedures.

If the testing of the installation and the billing did not include the Protection Plus audit assistance at the correct billing fee, contact your Sales Rep or Protection Plus help line at 866-942-8348.

Thank you for electing to use Protection Plus audit assistance. We are here to help increase your profit as you add a much needed value to your clients.

Easy Pay Option for E-Files

We now offer a great e-File payment option. To learn more click below.