What is Protection Plus

Thank you for choosing to partner with Protection Plus. Our goal is to make sure that we always provide you with the excellence in service you should expect from a professional audit assistance company.

Below is a complete list of instructions on how to enroll and install Protection Plus in your software in order to maximize your numbers and to increase your bottom line.

A comprehensive audit assistance program is available through Protection Plus, which is fully integrated in your software. The service works with 1040 returns, including Schedules A, C, and E, handles ITIN/W-7 rejections, assists in getting denied EIC claims funded, offers tax debt relief assistance, and pays up to $2,500 in penalties, interest, and tax liabilities should an error occur (exclusions apply).

How to Setup Your Markup

The first way for you to make more money as an ERO is to mark-up the Protection Plus amount. The base price is $44.95 and whatever you add to this will be returned to you in your tax prep fees. The maximum mark-up is $55.00 making the maximum cost of Protection Plus $99.95.

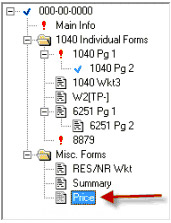

Price Sheet

If you plan to offer Protection Plus, the first step would be to add your price to the Price Sheet in the Tax Form Defaults.

To get to the Price Sheet in the Tax Form Defaults follow these steps:

- Log in as Admin

- Go to the Tools menu and select Edit Tax Form Defaults

- Select Individual – 1040 and click OK.

- A message displays “Any changes made will only affect subsequent new returns in this. user and package. Continue?

- Select Yes.

- Select the price sheet from the forms tree to the left.

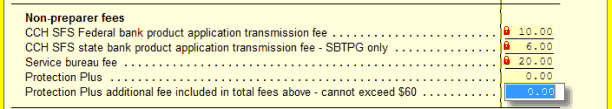

- Scroll down to the Non-preparer fees section of the price sheet and enter the following information.

- Here, you can add your additional cost for Protection Plus. Please note that the additional fee cannot exceed $59. Click the Close Return button to save the changes.

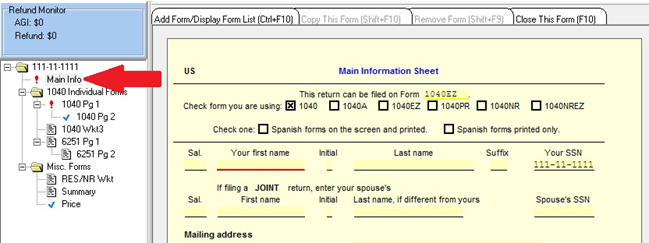

To Add to a Return

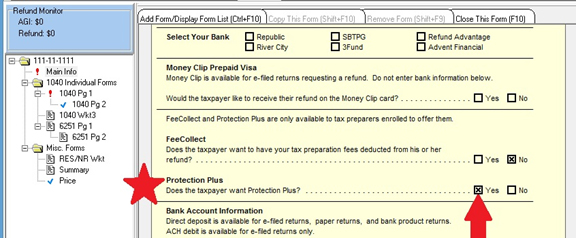

- To Enroll your clients with Protection Plus, Select “Main Info” from the forms tree to the left. The Main Information Sheet will be displayed.

- Scroll down to the Protection Plussection, and Select “Yes” next to “Does the taxpayer want Protection Plus?”

- The “P Plus”, “PP Use”, and “PP Disclose” forms will then display in the forms tree.

The Protection Plus Form

This is the Terms and Conditions form and requires no input on your part. When you have finished the clients return, this form will need to be printed out to be read and signed by the taxpayer, and spouse if applicable.

The Protection Plus Use Form

- Select PP Use on the forms tree.

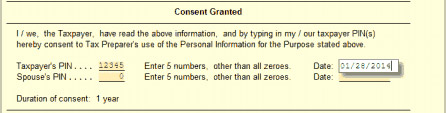

- Federal law requires that this consent form be provided to the taxpayer. Unless authorized by law a taxpayer’s tax return information cannot be used for purposes other than the preparation and filing of the tax return. By filling out this form, the taxpayer and spouse, if applicable, consents to all the use of their personal Information to determine eligibility for Protection Plus.

- Scroll down

- Click on the Taxpayer’s PIN text entry box.

- Input PIN.

- Input Date.

If the filing status is Married Filing Jointly, enter a Pin for the spouse and the date.

Disclosure Form

- Select PP Disclose on the forms tree.

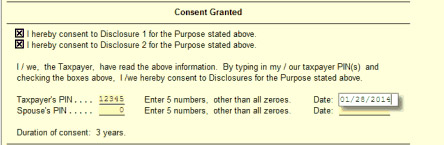

- Federal law requires that this consent form be provided to the taxpayer. Unless authorized by law we cannot disclose, without the taxpayer’s consent, their tax return information to a third party for purposes other than the preparation and filing of their tax return. This disclosure is to give the tax preparer consent to provide taxpayer personal information to the software developer through the tax preparation software and to disclose their personal information to the Software Developer who will then disclose that information to Protection Plus.

- Scroll down

- Select the appropriate check box indicating which Disclosure the taxpayer is granting consent for.

- Check Box1 (Taxpayer’s may grant consent for both Disclosures. )

- Check Box2 (If the taxpayer grants the consent they are required to enter a PIN in the space provided.)

- Click on the Tax Payer Pin text entry box.

- Input PIN.

- Input Date.

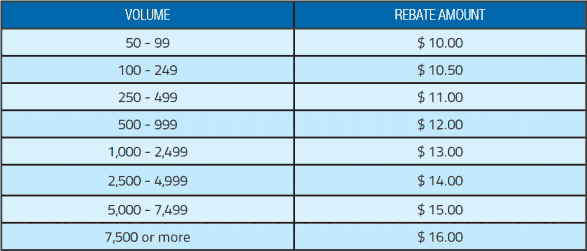

Rebates

By offering Protection Plus to your clients, not only will you relieve yourself of the headaches caused by IRS Audits, but you will also be able to make money. The second way Protection Plus generates income for you is through volume rebates. These rebates are based off of funded returns and are paid by May 30.